Credit cards

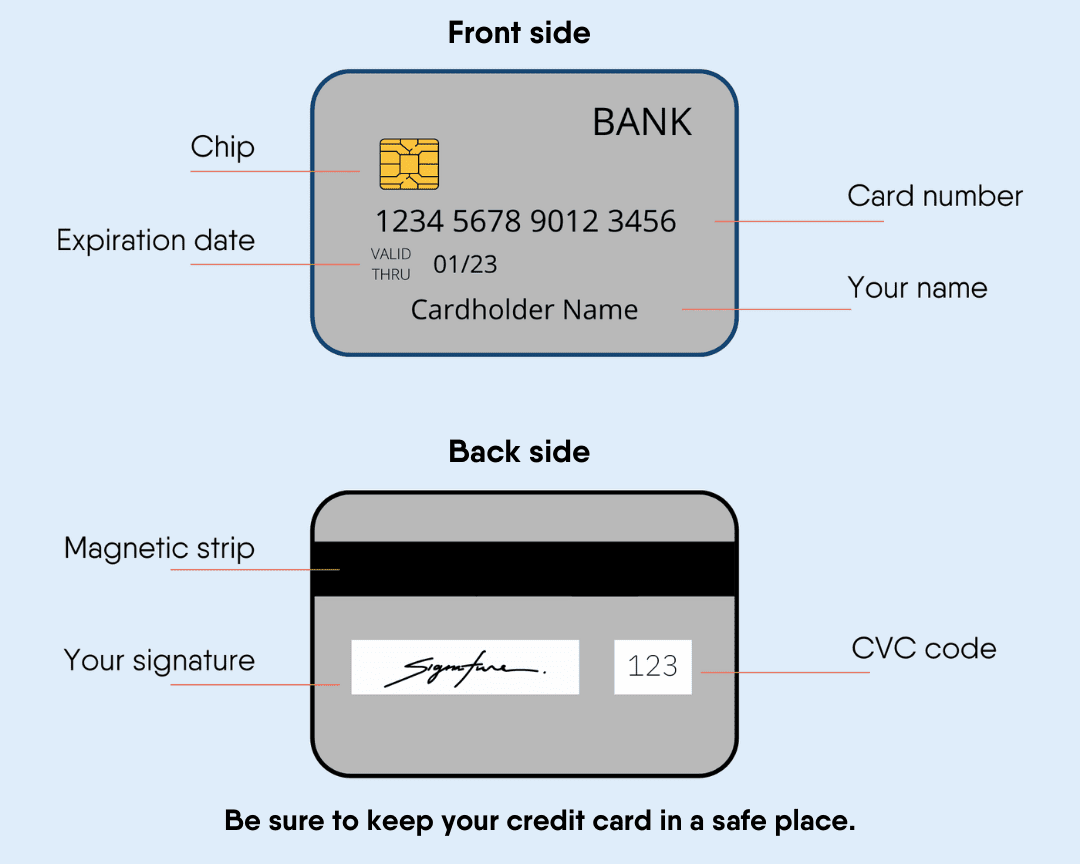

Millions of people have credit cards in the United States. People use credit cards when they shop online, pay for something expensive, or don’t want to use cash.

Credit cards are easy and safe to use. They usually have a limit on how much you can spend and require a minimum payment to the credit card company every month. It is important to always pay the minimum payment required or you will be charged a late fee.

If you do not pay the credit card company the full amount of all your purchases you will have a balance. The balance on your credit card will usually increase because of interest. Interest is an additional fee the credit card company charges for letting you borrow money. The balance is considered a debt.

Many people have a balance on their credit cards. Debt can be stressful. It is important to make purchases on a credit card you know you can pay off in a reasonable amount of time.

Find the best credit card for you.

د کارتونو نور ډولونه

There are other types of cards you can use in place of a standard credit card.

To open a secured credit card, you’ll need to deposit money. The minimum deposit is usually over $40, and in some cases, that can give you a credit of $200. The credit card issuer holds this money while the account is open. If you make your payments on time, you could earn back your deposit and upgrade to a regular credit card.

This type of card will help you build your credit history.

Prepaid cards are another option if you can’t get a credit card.

دا په دې باندې د ډیرو پیسو اندازه لري، او ځینې د ډیرو پیسو اضافه کولو اختیار لري. هر څوک کولی شي دا کارتونه واخلي. تاسو کولی شئ دا کارتونه په سوپر مارکیټونو، پلورنځیو او ګاز سټیشنونو کې ومومئ.

You can make purchases with a prepaid card the same way you do with a regular credit card. They can be helpful for USCIS payments and other payments online.

Having a prepaid card won’t help you build your credit history.

Watch this video about what happens when you don’t check the fees of prepaid cards.

Video credit: Federal Trade Commission

Debit cards can be used as you would a credit card. You can get a debit card after opening a bank account or credit union account. It doesn’t allow you to borrow money. It can only use the money in your account. Sometimes there are fees.

A debit card doesn’t help you build your credit. Learn more.

If you don’t have a social security number to apply for a credit card, some companies can accept your Individual Taxpayer Identification Number (ITIN).

Another option for those without a social security number is to use a secure credit card.

Loans

پور هغه پیسې دي چې تاسو یې د پور په توګه اخلئ او باید د سود سره بیرته ورکړئ. د پورونو ډیر ډولونه شتون لري: شخصي، معاش، سوداګرۍ، او نور.

پور معمولا د بانک یا مالي موسسې څخه اخیستل کیږي. دوی به وګوري چې تاسو د کار څخه څومره پیسې ترلاسه کوئ او که تاسو د ارزښت لرونکي شیان لرئ. دا د دوی سره مرسته کوي چې پریکړه وکړي چې ایا دوی د پور بیرته تادیه کولو لپاره په تاسو باور کولی شي.

Making your payments on time will keep you out of debt and help you build your credit history.

د معاش پورونه د هغو خلکو لپاره دي چې په چټکۍ سره نغدو پیسو ته اړتیا لري. خلک د پور ورکوونکي څخه پیسې پور اخلي ترڅو د پیسو ورکولو په ورځ بیرته تادیه کړي.

دا پورونه د نغدو پیشو پورونو په نوم هم پیژندل کیږي او معمولا لوړ سود اخلي.

د معاش ځینې پور ورکوونکي غیرقانوني کړنې کاروي لکه ډیر سود او غیر عادلانه شرایط. مهرباني وکړئ ډاډ ترلاسه کړئ چې تاسو د لاسلیک کولو دمخه د پور ټول توضیحات پیژنئ.

Credit unions offer Payday Alternative Loan (PAL). A PAL is a short-term loan, so you don’t have to get a payday loan.

You can borrow up to $1,000, and they will not charge so much interest. You have to be a credit union member for a month before taking out a PAL.

Mortgages are loans people get to buy a house. A lender checks your job history, credit score, income, and other factors to see if you can get a mortgage. Each lender has different interest rates and options.

Getting a mortgage can be complicated. It is good to ask your realtor or friends for suggestions on where to get a mortgage. You’ll need many documents like federal tax forms, pay stubs, bank statements, and more.

The Federal Housing Administration (FHA) has resources on mortgages and how to buy a home.

A permanent resident (Green Card holder) can get a mortgage. You’ll need documents showing that you are legally in the United States to apply. And you’ll need to follow the bank or lender’s requirements. Some required documents are:

- Green Card

- Passport

- د ټولنیز امنیت شمیره

- Recent pay stubs

- W-2 فورمې

- د مالیاتو بیرته ستنول

- د بانک بیانات

- Credit score

یو دایمي اوسیدونکی کولی شي د FHA پورونو لپاره هم وړتیا ولري. اړتیاوې او شرایط د متحده ایالاتو اتباعو ته ورته دي.

*غیر-دایمي اوسیدونکي کولی شي د ګروي لپاره هم غوښتنه وکړي. دا پروسه خورا پیچلې ده. غوښتن لیک ورکوونکي باید وښيي چې دوی په قانوني توګه په متحده ایالاتو کې دي. په ډیرو مواردو کې، یو غیر-دایمي اوسیدونکی باید بهرني عاید ښکاره کړي.

Student loans are for people looking for help to pay for school. You will have to pay it back later, with interest. The loans come from a bank, a financial institution, or from the government. Read more about student loans and find options.

There are scholarships for immigrants and refugees to help you pay for your education.

These are loans to improve or launch your own business. Usually, the lender has very specific ways you’ll be able to use the money.

ډیری سیمه ایز پروګرامونه د کډوالو او مهاجرینو سره مرسته کوي چې خپل کاروبار پیل کړي، د سوداګرۍ مشورې او د پیسو ورکشاپونه چمتو کوي.

Find help

ویب پاڼه | وړاندیزونه |

|---|---|

Home buying programs, loans for small business owners, and savings programs for refugees | |

Credit unions are like banks but are non-profits owned by their members. They are more likely to lend money or give credit cards to people with low incomes or no credit history | |

Loans money to small businesses, new businesses and to build affordable homes. They do not want to make a profit from their services | |

Immigration assistance loans so you can pay for the cost of your immigrant case | |

Business loans (from $500 to $250,000) to small business owners in Washington DC, Maryland, Virginia, and Puerto Rico | |

Helping communities to improve their access and understanding of credit unions | |

Helps you find a way to pay your credit card debt. Provides credit counseling and debt management programs | |

Loans to entrepreneurs with 0% interest for US small businesses. A nonprofit helping underserved communities | |

Loans to encourage business development and job creation for first-generation immigrants in New Hampshire | |

Loans and business counseling to immigrants and refugees with a limited credit history or unfamiliar with financial institutions | |

Loans for immigrants, and people with limited or zero credit history in the USA | |

Loans for your business that are guaranteed by the Small Business Administration |

How to build credit

Getting a credit card or loan requires you to have a credit history. Credit history is a record of how you use your money. It shows if you have used a credit card, had a loan, and paid your bills on time.

Secured credit cards are a good way to start building your credit. Paying your bills on time, such as your electricity and cellphone bills, also helps.

The information from your credit history goes to your credit report.

A credit report includes personal and financial information. Companies use this report to know you before lending you money or approving you for a credit card or a mortgage. Sometimes employers ask for this report during the job application process.

Based on your credit history, you’ll receive a credit score number. This number shows if you have good or bad credit. A high score is 700 and higher, and a low score is around 300. Having good credit will give you more choices when asking for a loan or paying less interest.

Learn more about building your credit history.

موږ موخه دا ده چې د پوهیدلو لپاره اسانه معلومات وړاندې کړو چې په منظم ډول تازه شي. دا معلومات حقوقي مشوره نه ده.